vanguard gold ira

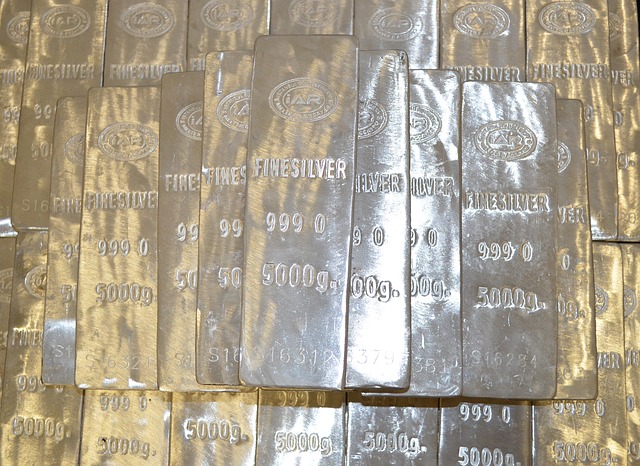

An IRA that is gold-backed offers several advantages over a regular IRA. For example, precious metal coins like the American Gold Eagle, Canadian Gold Maple Leaf or American Silver Eagle can be purchased. But gold IRAs have a tax burden. These precious metals must also meet purity standards. To qualify for tax exemptions, they must be at 99.5% or higher. These precious metals are stabler than stocks and exhibit less volatility.

There are several downsides to keeping your home-based gold IRA. Home storage is illegal. In addition, it could also lead to trouble with IRS. A lot of people are not fully qualified to manage their retirement accounts. These drawbacks are avoidable if you seek professional assistance. A self-directed IRA specialist is capable of managing gold IRAs. Their services offer peace of head and require minimal knowledge. These professionals are available to help you manage your gold IRA.